My local bagel store, barbershop and dry cleaner now only accept cashless transactions. Ubiquitous touchscreen displays and tap-to-pay checkouts now happily whisk customers through the line. Cashless transactions have been a boon for customer, employee (more tips!) and retailer alike. Mostly, I love it.

But with it has come unprecedented information flow on who we are, and increased temptation by platform providers to start monitoring who can be in their club and who cannot be.

While there isn’t yet any grand centralized design of a social credit system along the lines of what the Chinese Communist Party operates, I cannot help but worry that we are assembling the ideal toolset for ideological enforcement, monitoring and control should someone, some day, wish to network it all together.

Does that sound alarmist? Consider the overall trajectory of these recent stories:

October, 2022: PayPal Attempts to Fine Customers for What it Deems “Harmful” Ideas

On October 7th 2022, PayPal published amendments to its Acceptable Use Policy (AUP), which would have granted the payment provider legal authority to seize $2,500 from customers’ bank accounts for every single violation of what it deemed the spreading of “harmful” or “objectionable” information.

The determination of whether something is “harmful”, misleading or “objectionable” would come at PayPal’s sole discretion. These changes were set to go into effect on November 3rd, 2022, but were quietly retracted. PayPal only explained their policy reversal via emails to a few news outlets on October 8th; remarkably, you still cannot find any commentary about this episode on their Twitter feed.

What is harmful misinformation? Well, that’s subjective. We might all agree that businesses that explicitly promote murder shouldn’t be on the platform. But then it starts to get trickier. What if you believe the path of least overall harm was to reopen schools sooner? Or let vaccination be an informed choice, and not a mandate? Is being pro-choice or pro-life more “harmful?” Depends on who is answering the question.

Anything deemed harmful or objectionable by PayPal would be subject to such a fine.

Let’s review several recent statements which were authoritatively deemed “harmful misinformation”:

- “Prolonged school closure is a mistake. Learning loss will happen, suicide rates might increase. We need to reopen schools urgently.” (Misinformation in 2020, True today.)

- “Vaccination does not in fact significantly slow spread of COVID-19 to others.” (Misinformation in 2020, True today.)

- “Naturally-acquired immunity is as strong as immunity acquired through vaccination, if not stronger.” (Misinformation in 2020, True today.)

- “COVID-19, the most significant public health crisis in our lifetime, might well have emerged from a lab accident.” (Misinformation in 2020, officially declared at least equally plausible by the US government today.)

- “Hunter Biden’s laptop contained clear and troubling signs of influence peddling.” (Declared misinformation in 2020, yet now verified by New York Times, Washington Post and others.)

- “For younger males, the risk of myocarditis from vaccination may actually exceed the hospitalization risk of COVID itself.” (Declared misinformation in 2020, yet backed by empirical evidence today.)

Within a brief span of just thirty months, each of these statements has gone from “misinformation” or “harmful-information” as vehemently declared by authorities and name-brand “fact checkers” to now-majority American and empirically-validated viewpoints.

Further, who is paying attention to these stealth changes to terms and conditions? It wasn’t the New York Times, The Verge, nor the Washington Post that brought this major policy change of PayPal’s to America’s attention. It came from the right, who have become the most vocal critics of a creeping state-corporate symbiosis which they call the “Blue Stack.” The Blue Stack includes progressive technocrats, corporate media, and ostensibly independent big tech firms which work to enforce an ideology that inevitably tilts leftward.

The blue stack presents America’s elite with something they’ve always craved but has been out of reach in a liberal democracy: the power to swiftly crush ideological opponents by silencing them and destroying their livelihoods. Typically, American cultural, business, and communication systems have been too decentralized and too diffuse to allow one ideological faction to express power in that way. American elites, unlike their Chinese counterparts, have never had the ability to imprison people for wrong-think or derank undesirables in a social credit system.

Zaid Jilani, The Blue Stack Strikes Back, Tablet

Were it not for Ben Zeisloft, writer for the right-wing website Daily Wire, the public would likely not have known about PayPal’s major policy shift. But once Zeisloft’s piece hit (New PayPal Policy Lets Company Pull $2,500 From Users’ Accounts If They Promote ‘Misinformation’ | The Daily Wire), it caught fire on social media. And PayPal was forced into crisis-response mode, as the unwelcome press and cancellations started pouring in.

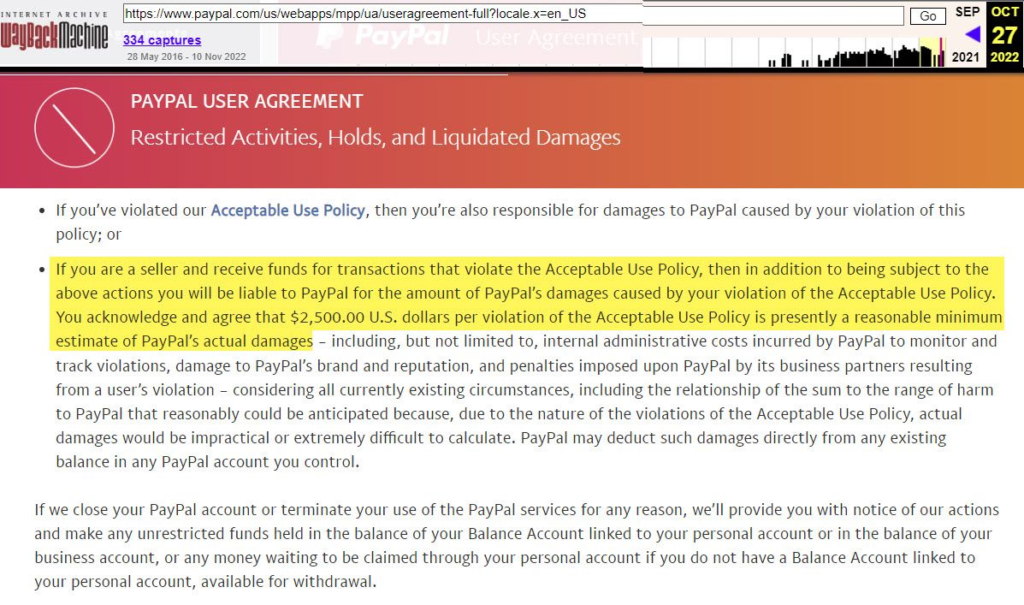

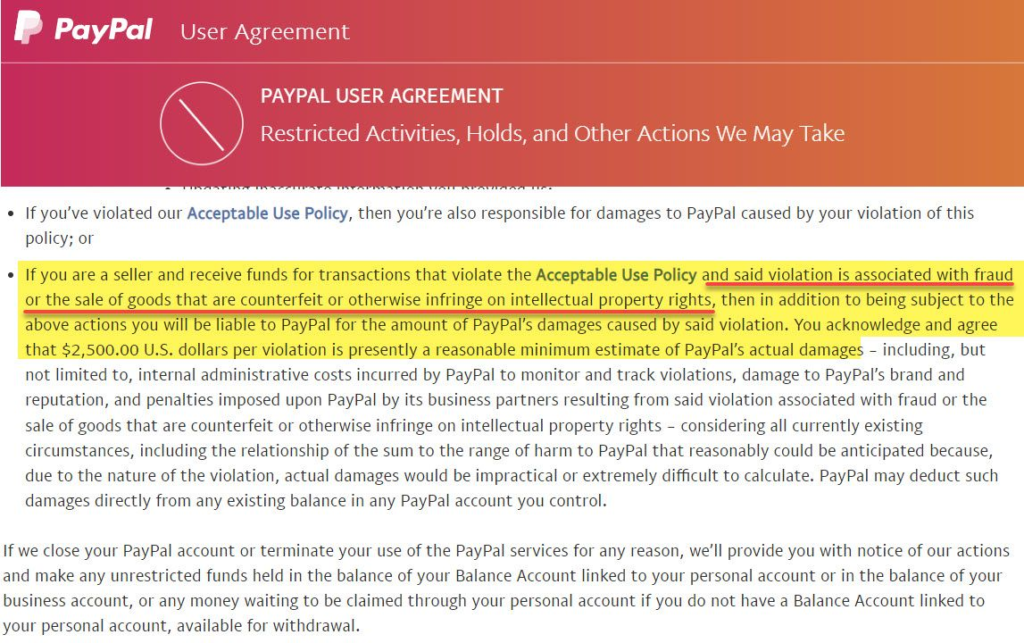

This wasn’t misinformation. PayPal’s new policy stated precisely as Zeisloft had identified. #CancelPayPal quickly started trending on Twitter, TikTok and Instagram. The proposed AUP changes are now gone from PayPal’s website, but here’s what it said on the web archive for October 27, 2022:

And here’s what it said after being as of November 11, 2022:

The company’s former CEO, David Marcus, blasted PayPal on Twitter, saying “It’s hard for me to openly criticize a company I used to love and gave so much to. But @PayPal’s new AUP goes against everything I believe in. A private company now gets to decide to take your money if you say something they disagree with.”, he wrote on Saturday.

PayPal handled this PR crisis very poorly. While they walked it back, they only did so via private emails to publications like Snopes, which dutifully penned “No, PayPal Isn’t Planning to Fine Users $2.5K for Posting Misinfo.” Snopes fails to clearly state that yes, PayPal indeed had.

And PayPal executives have yet to clearly explain to customers how this AUP change even arose. It all gives one the impression that the only “error” with this policy rollout is that someone skeptical noticed it. Their main Twitter handle, @paypal, was and still is silent on the rollout and stealthy walk-back. They reached out one-on-one with a few media organizations to state that it was an error, but they didn’t apprise the public. They didn’t explain how such an “error” could make it onto their corporate website.

October, 2022: JP Morgan Chase Summarily Closes Kanye West’s Accounts

I’ve never been a fan of Kanye “Ye” West’s music, erratic persona, nor many of his MAGA-political views. And his recent clearly antisemitic statements, deserve condemnation. I think they’re abhorrent.

Yet I’m also unsettled by JP Morgan Chase, Inc. summarily indicating they are closing his bank accounts based on his recent speech.

On the plus side, they’ve given him thirty days’ notice.

I admit on this I’m conflicted — I’m fine with this specific decision, but not what it says about the age we are now it. It is in effect a major bank saying you need to not only be a customer in good standing, but not stray from what its executives think are the norms of good speech. Are they saying it’s not just the bank’s services that set their brand, it’s the collective words and deeds of its customers?

Something feels new here.

Have corporate banking giants been arbiters of what we can and cannot say in our private lives? Do we want them to be? They’re private companies, after all, but who expected investment banks of all entities to be the enforcers of what they perceive to be social acceptability?

It feels absurd for bankers, of all people, to be America’s moral compass. Do you consider bankers to be America’s new home for ethicists, who will be able to determine what is and is not societally righteous?

February, 2022: GoFundMe Deplatforms “My Body, My Choice” Truckers

GoFundMe is the #1 marketplace and payment processor for fundraisers. As you may recall, the Canadian truckers who objected to that nation’s vaccine mandate headed en masse to Ottawa to protest the government’s mandate via what they termed a “Freedom Convoy.”

After raising over $10 million through GoFundMe, from people around Canada and the rest of the world, on February 4th 2022, executives at GoFundMe unilaterally decided to lock the truckers’ fundraising account. Further, in their initial statement, GoFundMe signaled they would distribute those funds to charities of their own choosing. “Given how this situation has evolved, no further funds will be distributed directly to the organizers of Freedom Convoy,” GoFundMe wrote about the decision. “We will work with the organizers to send all remaining funds to trusted and established charities verified by GoFundMe.”

After massive outcry, GoFundMe provided an update and said that they would instead refund donations. Many noticed their initial action and found it indicative of who they are. #BoycottGoFundMe made the rounds on social media for weeks.

Critics are right to point out that GoFundMe has hosted numerous fundraisers for Antifa, CHOP/CHAZ and other protest groups — even those around whom violence has occasionally happened — without cancelation or threats of unilateral fund-seizure. You can see just a few of them by searching PayPal’s site.

[Editorial note: I have stated my own views on vaccination: — I’m in favor of it personally and for most older demographics especially, but believe it to be a personal choice. It is now clear that vaccination does not measurably nor durably reduce spread (one such study here, others corroborate), I think vaccination should be an informed choice. I am firmly opposed to COVID vax mandates.]

PayPal, GoFundMe and JP Morgan Chase are each private companies, and have every legal right to set their own terms and conditions of use. But look also what’s happening at the governmental level.

August, 2022: Massive Increase to IRS budget, Considering Lowering Reporting Threshold to $600

In 1972, the Bank Secrecy Act started requiring banks to report deposits of $10,000 or more (in 1970 dollars.) Together with adjustments made by The Patriot Act in 2002, banks need to report to state and local authorities all deposits or withdrawals of $10,000 or more. (Even multiple transactions broken up into smaller pieces are tracked, and known as “structured transactions,” and that in and of itself is illegal.)

More recently, in 2021, Treasury Secretary Janet Yellen and others started advocating for lowering the threshold to $600. This hasn’t yet been adopted, but it’s being strongly advocated. With inflation, $600 is the new $500, so essentially most critical expenditures, like rent, furniture, car purchases, healthcare, travel and more are on the radar.

We often hear about “87,000 IRS Agents” authorized by the so-called Inflation Reduction Act, but really what the Act includes is a massive $79 billion budgetary expansion of the Internal Revenue Service. The IRS has every incentive and desire to start wiring in end-to-end tracking of cashless transactions.

Should the US want to pursue a social credit system along the lines of the Chinese state, all that really will be needed is the “right” lawmakers to authorize it doing so.

Republican Rep. Jefferson Van Drew has introduced HR 5475, known as the Banking Privacy Act, to stop the Biden Administration’s proposal, which has been referred to the House Financial Services Committee. Should the Republicans win control of the House, it’s possible this will be taken-up.

Of course, as the old saw goes, if you’re not doing anything illegal, you have nothing to worry about. After seeing the way COVID was and is handled, and the creeping power of what writer Zaid Jilani calls the Blue Stack, do you still have that confidence?

Themes

Fast-forward the videotape, and it is plain that without new regulation, we are fast headed to ideological groupthink being enforced by the financial world, who are of course also susceptible to the whims of government leaders. Consolidation and a pandemic-accelerated move to a cashless society are making a social credit system much easier to snap-in some day.

True, these actions are mostly the work of free enterprise. Companies aren’t state-controlled in America the way they are in China, and they are free to devise their own legal terms and conditions. We consumers are free to opt in or opt out. No one has to use PayPal, GoFundMe, JP Morgan Chase, Twitter or Facebook for that matter. I’m not aware of any of these activities being illegal.

But we need to pause a moment and recognize how a cashless society with higher concentrations of information flow and money are extremely tempting components for regulators and authoritarians on America’s political flanks. It’s a far cry from the local savings account that was largely agnostic to your speech.

Increasingly, outside groups, state and local governments and employees from within are pressuring banks, big technology companies and other corporations to take manifestly political/ideological stances, and expel people for wrongthink. Our massive migration toward a cashless society makes this easier.

That’s all fine, you might say, “I support Canada’s vax mandate for truckers, I think Kanye West is reprehensible that JP Morgan has every right to de-bank him from their system, and I think think the IRS’s investment in tracking every $600 will inure to much greater revenue to US coffers.”

But recognize that these monitoring tools and platforms themselves are entirely agnostic tools; their application merely depends upon who is in power. And that can change at any election.

So it’s an important exercise to take a moment to imagine the power which you may now applaud in the hands of your worst ideological foe. Are you still comfortable with how this is all trending?

For me, though I love technology and the convenience it offers, these trends to include speech and behavior in whether people can participate in a platform start to fill me with unease, especially when they are phrased in such a subjective way. After more than two decades as a customer, I closed my PayPal account last week. If you’d like to close your account, you can do it in a few clicks as I explain on Twitter.

And while I’m still fine with debit and credit cards, I’m beginning to suspect this sense of ease might not last forever. It only takes VISA or Mastercard to say “we will fine our customers for harmful misinformation.” For these and other reasons, this long-time advocate of technology is now becoming reacquainted with check-writing. I’m not ready to switch back to paper just yet, but it can’t hurt to re-learn how it worked in the 70’s.